Donald Trump has been telling everyone that he’s going to cut business taxes to 15% and make up the reduction in federal income by introducing a consumption tax. According to him, this will kick start the US economy and bring back well-paid jobs. He has support for his plan in the Republican House and Senate, so it’s likely to happen in some form.

Trickle-Down Economics

The Trump formula, at its core, is the debunked theory of trickle-down economics. Trickle-down economics seems logical but analysis and history show it doesn’t work.

The logic goes that you increase an employer’s income and the employer will spend the extra on creating more jobs. That will reduce unemployment and increase the average income. Thus, the spending power of citizens increases and the government will regain their lost funds via income and the new consumption taxes. Sounds good right?

The trouble is, trickle-down economics relies on employers using the extra money they get from tax cuts to create jobs. However, that only happens if they have been unable to meet demand with their current income. In the United States, that it not currently the situation.

Trump has used the coal industry as an example. He says that reducing taxes and regulations will revive the industry and get miners back to work. It will not. Coal is a dying industry, and promising to revive it is like promising to create thousands of new jobs for farriers. Worldwide coal prices are at historical lows. Nobody wants to buy coal, therefore there is no point in producing it. It makes no difference what Trump does unless he plans to buy it all himself.

The So-Called “War on Coal”

In coal country, especially West Virginia, Kentucky, and Pennsylvania, Donald Trump attracted voters away from the Democratic Party by promising them he’d get them their jobs back. The trouble is, this is not possible. As so often with Trump, the promise is a lie. A report in Time sets out some of the reasons:

Total coal production in U.S. mines declined to about 900 millions [sic] last year, only three-quarters of production in 2008, according to EIA [Energy Information Administration] data.

Coal also struggles to compete with renewable energy sources like wind and solar in locations where those resources are abundant. The cost of solar panels in particular has declined precipitously thanks to technology advances in recent years. Even conservative states like Texas and Oklahoma have become fast adopters of widely available wind energy.

“Trump is not going to bring all the coal jobs back,” says Jason Bordoff, founding director of the Center on Global Energy Policy at Columbia University. “There isn’t a lot of investment activity because in some cases it looks more economically attractive for firms to invest in cleaner technologies.”

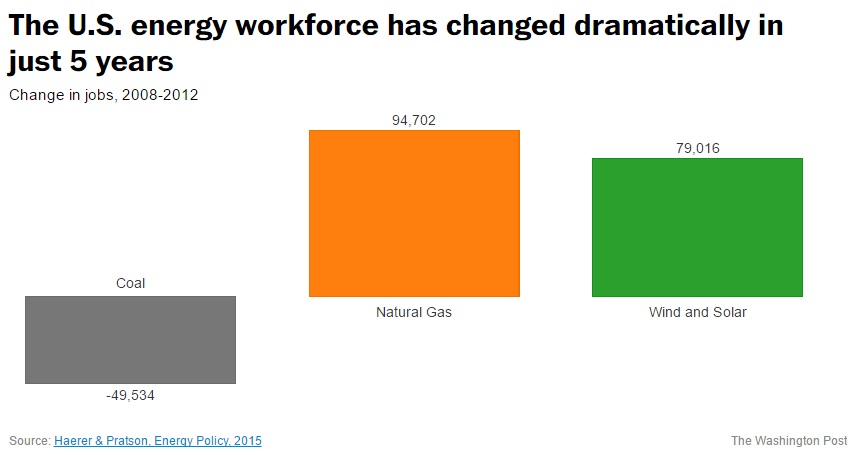

Beyond the competition jobs in the coal industry have also disappeared in recent decades as a result of mechanization that began in the 1980s. Approximately 50,000 coal-related jobs have been lost between 2008 and 2012, according to a study from last year. Even if coal production increased, those jobs would not return.

Click graphic to go to Washington Post article ‘Study: Coal industry lost almost 50,000 jobs in just five years’. As can be seen, jobs lost in the coal industry are more than made up for in other energy sector industries.

Moody’s Liquidity Stress Index

Moody’s Investors Service analyses multiple economic indicators worldwide. They announced on 2 December that the US Liquidity Stress Index had fallen in November for the seventh month in a row to 6%. That is its lowest level for over a year. Moody’s tells us:

Moody’s Liquidity-Stress Index falls when corporate liquidity appears to improve and rises when it appears to weaken.

Basically, what this means is that US businesses have enough money operate in the current environment, and this situation has been improving for some time. In other words, it is not lack of funds that is preventing businesses from expanding and therefore tax cuts won’t change anything.

In addition, most of the companies who have liquidity difficulties are in the oil and gas sector. Their problem is the current low price for oil internationally; tax cuts won’t help them either.

Overseas Funds

However, many companies are hoarding their cash overseas to avoid paying tax on it. Estimates are that at least US$2.5 trillion is held outside the country. A law that enabled companies to bring that cash back into the country at a reduced tax rate may have a positive effect. At the very least, if it was held in US banks it would be available for borrowing. It’s something both parties have been talking about, and one party holding all three branches of government should allow it to happen.

Investment in Infrastructure

That money though could also artificially raise the value of the stock market, which is already at record highs. A big reason for this is the lack of other investment opportunities, which the Trump administration could create. The country is in dire need of quality infrastructure projects. Amazingly, the US has no ports capable of handling the latest, biggest class of container ships. Roads, bridges, airports, inner-city schools, and low-cost housing are all areas that need significant work. Trump has spoken of investing in infrastructure, and this would be a positive move. It would create jobs “big league.” Obama tried to do some of this, but was blocked by a Republican congress. Perhaps Trump would have more luck.

However, his focus is his “big, beautiful wall” on the southern border. This does not meet the criteria of “quality” infrastructure project. Former Secretary of Labour Robert Reich states that the best estimate he has seen of the cost of the wall is US$28 billion. He points out it is not necessary because the situation on the border has improved significantly in the last eight years and crossing are now at their lowest level since the early 1970s.

Part of the reason for the success is there has been significant cooperation between the Obama Administration and Mexico. The Trump approach to diplomacy is such that the good relationship between the two countries is damaged before he’s even in office. His demand that Mexico pay for the wall is not only counter-productive diplomatically, it will increase costs of goods coming from Mexico for US citizens.

The Jobs President

The Jobs President

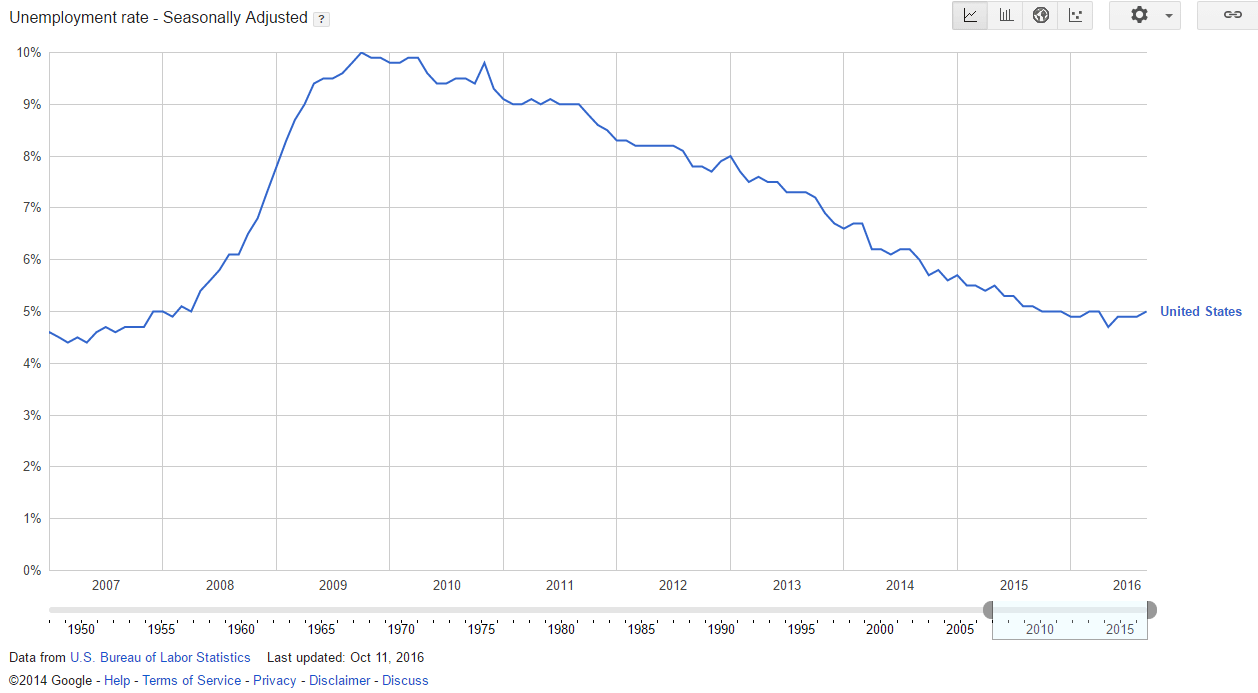

Donald Trump tells USians he, “will be the the greatest jobs president God ever created.” His plan will not only not create jobs, it’s not actually unemployment that’s the problem. Unemployment has been steadily reducing since it hit a high of 10% in October 2009. It currently stands at 4.6% (Nov 2016).

The US unemployment rate is low by international standards. It is just below the OECD average, and significantly below the international average.

Unemployment is not currently a problem in the United States, but it could be. Trump’s tax cuts for businesses coupled with a new consumption tax are more likely to cause unemployment than reduce it.

Why Is Unemployment More Likely To Rise?

The people who will initially have more money following a tax cut are the business owners. As pointed out above, they don’t need the money to expand their businesses. Most already have enough to do that if they wanted to. They haven’t done it because there is no demand. There is no point increasing production if you can’t sell the additional product. (I wrote about this at length back in March 2016.) Instead, they will either save the money or invest it in the already bloated stock market. Banks will be cash rich which will depress inflation, and the stock market will become artificially high. This is a problem because:

1. Some inflation is needed to help stimulate the economy and;

2. An artificilly high stock market means a crash will come. That affects everyone because it reduces the value of retirement investments and part of the fallout is a reduction in property values.

Most importantly, Trump plans to pay for this tax cut for businesses with a consumption tax. Presumably this will be like New Zealand’s GST (goods and services tax) or Great Britain’s and Canada’s VAT (value-added tax). There are good reasons to have a consumption tax, and the US federal government is going to need the money. What it will mean in the situation in which it’s being introduced though is a further reduction in demand. The cost of most or all goods will increase with no corresponding decrease in income taxes for most taxpayers. Therefore most people will spend less and demand will decrease.

If people have to spend more on essentials like food, housing, and travel they will have less to spend on other items they deem less essential. Producers of those items will experience a reduction in demand and may have to lay off employees.

The History of Tax Cuts and Unemployment

Income tax cuts for the poor and middle class stimulate growth. That is because they mostly spend the extra income. Tax cuts for the wealthy do not unless they are paying extraordinarily high taxes. It doesn’t matter how many boats, cars, and houses a wealthy person buys. It’s never enough to make up for the number of everyday items bought with the same amount of money spread amongst poor and middle-class people.

The Congressional Budget Office found that the best way to boost economic growth is to extend unemployment benefits. The poor always spend pretty much all of any extra money they receive, which creates demand. The increased demand means employers create more jobs, moving an unemployed person from a government benefit to an income.

Trump isn’t cutting taxes for the poor or middle-class though. He’s increasing them via an indirect tax to pay for a business tax reduction.

Tax cuts for business are useful in times of high unemployment and high inflation but neither of those conditions currently applies in the US.

The “Tax Cuts Increase Revenue” Myth

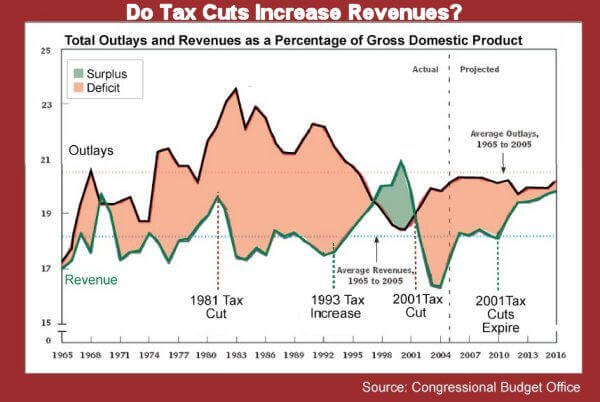

Trump says tax cuts increase revenue because they increase growth. Here is the history of tax cuts vs growth in the US:

As can be seen, tax cuts have historically decreased revenue in the United States. When taxes on the wealthy are increased to make the tax system more progressive, revenue increases. Enough said really.

If you’re living in the United States, this mic.com article, ‘Your 2017 Money Guide‘ provides some good advice.

If you enjoyed reading this, please consider donating a dollar or two to help keep the site going. Thank you.

More money in corporate pockets allows for more automation to be invested in.

And that will happen whatever Trump does, and the pace will get faster. What he should be doing is working out what to do with all the people who are going to lose their jobs through automation and how to educate the kids of the future to deal with it.

I think it was Reagan’s budget director, David Stockman, who later said cutting taxes to stimulate the economy did not work. The only investment strategy in the U.S. since the bust in 2008 has been the stock market. Interest rates at almost nothing leaves no other choice. And speaking of that strategy, my recommendation now would be to reduce what you have in this market. With the loose nut at the wheel the ditch will not be too far ahead.

Yes. Although some businesses are coming back because their profits are going to be higher, retail giants are already pulling back. They’re cutting the number of stores big time and saying it’s because of on-line shopping. That’s undoubtedly some of the story. However, most of them will not actually say both how much on-line has increased compared to how much in-store has reduced in order to allow a comparison.

True, some of our old retail giants are in trouble, Macy’s, Sears/Kmart and on it goes. Even Walmart is not doing great. If demand is down, giving the rich a tax break and adding consumer tax is exactly the wrong thing. The rich would not be caught dead shopping in these places. They might run into the people who clean their houses and mow the lawn.

Regarding your comments about why unemployment may rise, I would add the specter of automation. Apparently, economists are vigorously debating about the role of automation in creating unemployment, perhaps on a very large scale. Enough of them are seriously concerned, so I would not take lightly the possibility that automation could cause massive disruptions in virtually all the economies of advanced nations. If this should happen the masses may turn to a strongman, who will make Trump look like your benevolent, old uncle. We are entering perilous times.

Economists seem to agree that automation is the bigger factor in loss of factory jobs, not China.

Yes, definitely. Countries like China are only being used because their labour is cheaper. Those companies will come back to the US as soon as automation is available to do the work cheaper than overseas workers and thus coming back will create very few jobs. That is why things like a universal basic income needs to be looked at.

I definitely don’t take the role of automation lightly. In fact I think it’s going to be one of the biggest factors in unemployment going forward. Even many jobs that we currently can’t imagine being done by automatons, will be before too much longer.

And yes, people will get scared and when that happens they turn to authoritarians. We need to be talking about it now, and how we’re going to deal with it.

Why do you think inflation stimulates the economy? The direction of causation generally runs the other way….a strong economy stimulates inflation. I refer you to the “stagflation” in the US in the late 70s.

A small amount of inflation is good. When it gets to stagflation, which we had here too, it is a problem.

One of the things I didn’t write about is how people feel at the moment. The economy is actually pretty good, but they don’t feel that way and the reason for that is lack of inflation. It means any savings they aren’t earning anything in the bank while they watch the wealthy reap the rewards of the stock market. Those who are living off savings (like the elderly) are screwed because the value of their money is going down. And employers have an excuse not to increase wages. When there is low but not no inflation, wages generally increase faster than inflation because the economy is growing.

Anyone who remembers what it was like when we had stagflation (and I’m one of them) finds it hard to get their heads around the fact that a small amount of inflation is good because it means the economy is growing.

The poorer folks and middle income have been going backwards for many years here. I am pretty sure the economist have documented this. Even with so called lower inflation prices do increase and they are going up faster than wages. This trend goes back to the 60s. This is what the American politicians have done nothing about. Instead the good paying jobs go away to automation and movement to other places. Pension plans are almost gone in the private sector so see how far you get with a 401K. Medical expenses and inflation in that area are way beyond normal inflation. Few people can buy houses and that use to be the measurement in the U.S. To own your own home. What did any of the politicians come up with to help stop this trend? If only 80 percent even graduate from high school what happens to the other 20 percent? How many high school graduates with no further education get to own a home and who keeps those stats? The American dream for many of these people is not to get thrown out of their low rent housing. What is Trumps plan for education?

Interesting. I don’t know so much about your economic history and assumed it was similar to ours because the broad strokes are the same. We too have a problem with less and less people owning their own home. However, that is because both central and local governments have stuffed up by simply not releasing enough land in our biggest cities for residential development. Auckland is now I think the most expensive city in the world to live in compared to income – the average house price is over NZ$1 million, which is outrageous. The average NZ wage is about NZ$55,000.

Out economy is growing because of exporting and successive governments have made FTAs with multiple countries. We were the first one in the world to make one with China for example, and they’re now our biggest export market. We are too small to grow much economically without exports. The US needs to do the same, even though you’re obviously much bigger. Trump turning away from the rest of the world is going to damage the economy. The only way really for first world countries to make money is to sell to the middle-class in emerging countries. Your population is not growing much and there aren’t enough people for countries like ours to grow much economically without looking outwards.

And yes, as I wrote recently, things in the US re education are looking really bad. We don’t know of course exactly what’s about to happen, but the indicators aren’t good. I don’t think Trump has a plan. He’s happy to leave it to DeVos and her religious extremist friends, which will be disastrous imo.

Heather, there are several other reasons more important than land supply for why NZ has a shortage of affordable housing. I know you don’t like to debate NZ politics, but it’s difficult for me to keep quiet about oversimplifications like this!

Yes there are other reasons but currently I think that’s by far the most important. If that was fixed it would make a huge difference.

Trump’s plan for education is to further gut public school systems via privatisation.

https://www.youtube.com/watch?v=47OC7wZbwzM

Very scary!

Excellent!! There’s little the federal government actually can do to reform education policy, but having strong pro-choice and pro-reform leadership nationally nevertheless is a wonderful and very welcome change. Let the unions squeal and holler — that’s the sound of progress.

I wish people would remember all the gains that have been made because of the union movement. The 40 hour week, the 5-day work week, annual leave (not that USians get much of that), sick leave, health and safety regulations, minimum wages, and more.

Here are 36 reasons why you should thank unions. This is especially for people like j.a.m.

Weekends without work

All breaks at work, including your lunch breaks

Paid vacation

Family & Medical Leave Act (FMLA)

Sick leave

Social Security

Minimum wage

Civil Rights Act/Title VII – prohibits employer discrimination

8-hour work day

Overtime pay

Child labor laws

Occupational Safety & Health Act (OSHA)

40-hour work week

Workers’ compensation (workers’ comp)

Unemployment insurance

Pensions

Workplace safety standards and regulations

Employer health care insurance

Collective bargaining rights for employees

Wrongful termination laws

Age Discrimination in Employment Act of 1967 (ADEA)

Whistleblower protection laws

Employee Polygraph Protection Act (EPPA) – prohibits employers from using a lie detector test on an employee

Veteran’s Employment and Training Services (VETS)

Compensation increases and evaluations (i.e. raises)

Sexual harassment laws

Americans With Disabilities Act (ADA)

Holiday pay

Employer dental, life, and vision insurance

Privacy rights

Pregnancy and parental leave

Military leave

The right to strike

Public education for children

Equal Pay Acts of 1963 & 2011 – requires employers pay men and women equally for the same amount of work

Laws ending sweatshops in the United States

@MR: Leave aside whether all of the items on your laundry list are net benefits, and to what degree we ought to chalk them up to the influence of organized labor. It still doesn’t mean they’re right on every issue in every circumstance.

Moreover, there is a huge difference when it comes to unions representing government workers. By definition, these unions campaign expressly to prioritize their own PRIVATE interests against the PUBLIC interest.

It doesn’t matter how many boats, cars, and houses a wealthy person buys. It’s never enough to make up for the number of everyday items bought with the same amount of money spread amongst poor and middle-class people.

Yes, this is the simple logic that republicans simply don’t get. It’s really just a math problem. What does more to strengthen an economy, one family that makes a $1,000,000,000/year, or 19,230 families that make $52,000/year (mean US income)?

I don’t know of any billionaire who owns/rents 19,230 homes/apartments with all the added costs outside of mortgage/rent (appliances, furniture, general maintenance, energy costs), 40,000 cars (assuming 2 cars per family), 19,229 times the amount of food, iphones, computers, tvs, pets…ok, I think most get the picture, but many don’t understand this simple reality. Extremely wealthy families (the 2%) are a huge drag on the economy. But when it comes to republican tax policy, ideology trumps reality…pardon the pun.

Your other points are well made too. Just the fact that trickle down has already been tried and shown to fail over and over again drives me f’n crazy.

Exactly!!! You give 10,000 people an extra $1,000 a year, they will spend the lot. You give a couple of people a $5 million bonus, very little will get done with it.

Multiply that out and it’s easy to see how spreading money around a lot of people rather than a few will create jobs because it will increase demand.

Inflation is a symptom of increased demand, which is why a small amount is a good thing.

Also, note that Trump’s infrastructure plan is bogus; he plans to offer tax breaks to private companies that invest in infrastructure, using private capital. For these projects to make financial sense, they need to generate revenue, which means toll roads. This isn’t what we need.

Some of the money will get reinvested, perhaps a lot, but in other countries. It will go where the return is largest, regardless of Trump’s promises to create jobs in the US. This is what happened when Reagan did it and was a big contributor to his historically huge budget deficits. Then, Dems tried to put restrictions on the tax cut money flowing overseas, but of course the Reps wouldn’t go along with that, because it would restrict people’s freedom, they said. Then as now, the goal wasn’t to benefit working Americans but to ensure the rich are free to get richer.

A consumption tax is inherently regressive. When you talk about income taxes, they are generally adjusted in a way people who earn more pay a higher percentage. This is called progressive taxation. That is not possible with a consumption tax. It does not matter if you earn 300,000 a year, or 40,000 a year, the amount of tax you are going to pay for a pound of beef is exactly the same. Since low and middle class citizens spend relatively more in consumption items than the rich, they will have a larger portion of their income eaten off by the consumption tax.

Of course, that would not be a surprise coming from a Trump administration.

(Excuse me for the mistakes, English is not my native language).

I would agree with your comments in general. However, we also know the tax laws in this country give plenty of alternatives to the higher income groups to wipe-out those progressive income taxes. So the rich or well to do get the benefits either way. Home ownership for a start, and the ability to use Schedule A can turn those higher taxes into greater savings. You only have to look at anyone with a 2 to 3 hundred thousand income to see this. This is also why Warren Buffet, who does pay taxes as appose to Trump, said many times that his secretary paid higher tax rates than he did.

Yes, that is the problem with consumption taxes.

With many in the US though, especially in the GOP, there is a different attitude. Personally I think it is attached to the type of religiosity there, where so many believe people are poor, sick etc because they deserve it. A flat income tax there is known as a “fair tax” and those that run on it tend to be the most extreme of the Protestant religious – the Dominionists – like Ted Cruz and Mike Huckabee. Of course, a flat income tax is about as unfair as they get. Others who favour them are Libertarians, which imo is an extremely selfish outlook.

Strange, this kind of religiosity. IIRC, there was some talk about camels and the ‘eye of the needle’…?